Payments in India

UPI for Mauritians Visiting India

The Unified Payments Interface (UPI) is a payment switch developed by the National Payments Corporation of India (NPCI) that connects all Indian banks, enabling instant fund transfers between them. Moreover, the UPI system is connected to equivalent payment switches in other countries, including the Mauritian MauCAS system. Since POP is connected to MauCAS, Mauritian bank account holders using the POP app can now scan and pay any UPI-powered QR code in India.

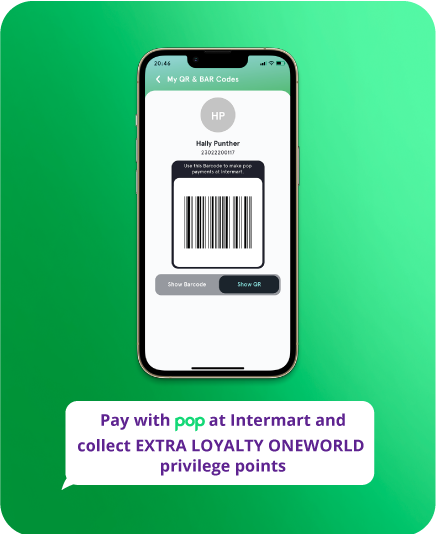

Using UPI with POP is as easy as chai! Follow these steps:

- Open your POP app and ensure it’s updated.

- Scan the UPI QR code at any participating merchant in India.

- Enter the amount in INR and confirm the payment.

- Confirm the transaction by entering your PIN.

- The equivalent amount in MUR will be deducted from your Mauritian account, and you’re done

What if the merchant doesn’t receive the payment?

If the payment doesn’t go through, don’t panic! The amount deducted will be instantly reversed to your bank account. You can double-check in your POP app or bank app.

Will I be able to make a payment without internet connectivity?

You’ll see the converted amount in MUR. For example, if you’re paying INR 2,000 and the rate is 2 INR = 1 MUR, you’ll see MUR 1,000 deducted. Confirm, and you’re all set!

The exchange rate is set by the regulatory bodies of Mauritius and India and will be automatically applied when you make a UPI payment

Nope! POP doesn’t charge any additional fees for UPI transactions.