Terms & conditions

Download as a PDF here

The present Terms and Conditions (“Terms and Conditions”) stipulate the terms and conditions under which pop Team provides to the Customer and the Customer agrees to access and use the pop Application, as defined under Clause 3 below. The access to the pop Services is subject to the acceptance of the present Terms and Conditions by the Customer.

Recitals

- pop Team has developed a Mobile Payment Application, as defined below, through which it provides the Customer with access to selected payment services on the Customer’s Device/s and to other payment and service options, as detailed in this pop Terms and Conditions available on the Website of pop Application and which the Customer hereby declares having read, perfectly understood and agreed to;

- By completing the corresponding registration formalities electronically, the Customer is willing that pop Team provides the pop Services to the Customer, which Bank One has agreed to.

- pop Application shall be available in English, French and Mauritian Creole.

1. Definitions and Interpretation

The following expressions used in the present Terms and Conditions shall have, except where not appropriate in the context, the meanings as described hereunder. The headings in the present Terms and Conditions are for convenience only and shall not affect their construction or interpretation. The plural shall include the singular; the masculine shall include the feminine and vice-versa.

“Account Number” refers to the Customer’s bank account number or wallet number with any MauCAS participant which is linked to the pop Application.

“API” refers to Application Programming Interface.

“Bank One” refers to Bank One Limited, a commercial bank licensed by the Bank of Mauritius.

“Biometric ID Service” refers to a service available on the pop Application whereby the Customer uses his biometric data registered on the Customer’s Device as a security measure “in lieu” of the Customer’s mPIN to confirm the Customer’s identity for the purpose of accessing the pop Application or authenticating transactions on the pop Application.

“Customer” refers to a person of age who has successfully registered for the pop Services on the pop Application.

“Daily Transaction Limit” refers to the cumulative daily transaction limit established, from time to time, for pop Application.

“Device” refers to a mobile phone, smartphone or any other equipment connected to the internet to access the pop Application.

“Device Pairing Process” refers to the process of registering the Customer’s Device as a trusted device for accessing pop Application.

“Help Centre” refers to a relevant section of the pop website which contains information, documentation and media to assist Customers to understand and use pop Services

“Login Password” refers to the password set in pop Application by the Customer which, when coupled with the Customer’s User ID Code, gives the Customer access to the pop Services.

“MauCAS participant” refers to a body, as defined in the National Payment Systems Act 2018, which is recognized as eligible to exchange, clear and settle with other participants through the Bank of Mauritius’ Instant Payment System.

“Merchant” means any person, entity or trader accepting pop Service as a mode of payment at its outlet and/or on its E-commerce portal.

“MNO” refers to Mobile Network Operator.

“Mobile Payment Transactions” refers to any financial transaction with fund movement undertaken using a mobile device such as a mobile communication device whether the fund transfer takes place from the stored value in the mobile device, or from a bank account.

“mPIN” refers to a four digit mobile PIN set by the Customer which is paired exclusively to the Customer’s Device and used for authentication and validation purposes for the pop Application.

“OTP” refers to a one-time password which is a system-generated code sent by pop Application through SMS to the Customer’s Device or initiated from a security token to confirm a transaction to be undertaken by the Customer through the pop Application, when applicable.

“pop” refers to the registered trademark in the name of Bank One Limited, which will be used to identify the pop Application and pop Merchants.

“pop Application” refers to native application versions of a mobile payment system, for iOS and Android platforms, which can be downloaded and directly installed on a Device.

“pop Beneficiary Registration” refers to the automatic registration of a Customer as beneficiary on the pop Application enabling the Customer to receive funds on the Customer’s chosen Account Number through the Customer’s registered mobile phone number or email address.

“pop Merchants” refers to the acquiring platform accessible for Merchants to accept and manage payments through pop Service.

“pop Support” refers to the support arm of the pop Team responsible for providing support to Customers and Merchants of the pop Application and pop Merchants.

“pop Services” refers to the services enumerated at Clause 3.

“pop Team” refers to the administration and management team of the pop Application and pop Merchants. For avoidance of doubt, the legal entity representing pop Team is Bank One Limited.

“Privacy Policy” refers to a legal document regulating the gathering, disclosure and use of Customer’s data.

“Push Notification” refers to notifications sent to a Customer on the latter’s Device for informative or marketing purposes.

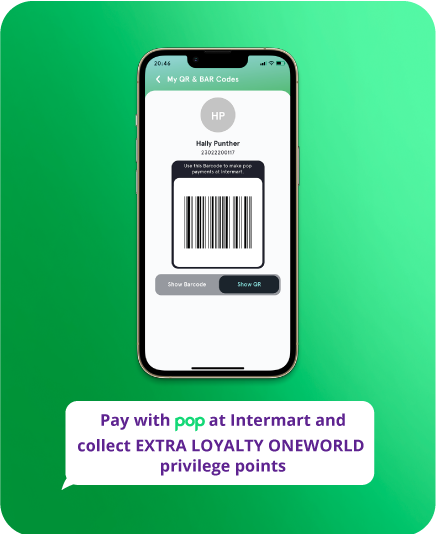

“QR Code” refers to Quick Response Code, which is a two dimensional bar code containing information that can be read by a QR Code Reader to initiate the payment for goods and/or services with a Merchant.

“QR Code Reader” refers to the “Scan & Pay” module of the pop Application which uses the Device’s camera in order to capture and interpret a QR Code.

“Registered mobile phone number or email address” refers to the Customer’s mobile phone number or email address, as the case may be, registered with pop Application.

“User ID Code” refers to the registered mobile phone number of the Customer which enables identification of a Customer on the pop Application.

“Verification Code” refers to a system-generated code which will be sent through SMS to the Customer’s Device to complete the Device Pairing Process.

“Weekly Transaction Limit” refers to the cumulative weekly transaction limit established for pop Application.

2. Eligibility

To register for pop Services, the Customer must:

(a) be at least 18 years old at the time of registration;

(b) be an active registered Mobile Phone Number with a MNO; and

(c) have access to internet on Customer’s Device.

3. pop services

The services and features available on the pop Application include but are not limited to the following:

(a) Payment Services

i. Initiate Person to Person (P2P) Payments (“Transfer”)

ii. Pay a Merchant in exchange of goods and/or services by means of a QR Code Reader or via a mobile number designated by such Merchant (“Payment”)

(b) Offers Section

(c) Mobile Recharge

(d) pop recent transactions

(e) Push Notification

(f) Biometric ID Service

(g) User profile image management to enable the Customer to personalize the Customer’s profile picture on pop Application through the use of images available on the Customer’s Device

(h) Split and Pay Bills

(i) Add or Manage Beneficiaries

(j) POP Save

(k) POP Insure

The above services and features, including the Daily Transaction Limit and the Weekly Transaction Limit, can be reviewed by the Bank from time to time.

4. Availability of pop services

(a) pop Services shall be available to the Customer twenty-four (24) hours a day and seven (7) days a week, subject however to Clauses 4.(b) and 4.(c) below.

(b) The above-mentioned availability hours, all or part of the pop Services may be varied, suspended or discontinued without prior notice to the Customer, although in such cases pop Team shall use its best endeavours to advise the Customer to that effect as soon as may be reasonably practicable by whatever means that pop Team may deem fit and appropriate.

(c) The date and time referred to on pop Application, pop Merchants and/or pop website or any other document relating to the pop Services shall be the date and time prevailing in the Republic of Mauritius.

5. Registration to pop services

The Customer can activate pop Application as follows:

(a) Download pop Application from relevant application stores on a Device;

(b) Open pop Application;

(c) Follow the registration process;

(d) Accept this Terms and Conditions and the Privacy Policy;

(e) Link at least one Account Number to the pop Application; and

(f) Complete customer identity verification process as may be determined by pop Team

We reserve the right, after verification of the data and documents provided, to impose new documentary requirements before registering the Customer or rejecting the registration of the Customer. Following successful registration, a confirmation message will be displayed on pop Application.

6. Conditions of use of pop application

(a) Any transaction amount exceeding the Daily Transaction Limit or Weekly Transaction Limit established in pop Application shall be declined.

(b) The Customer has the possibility to install pop Application on multiple Devices for accessing the pop Services. However, only one active session can be run on a Device at a point in time.

(c) Depending on the Customer’s profile, the Customer shall be mandated to confirm a transaction by using either OTP or mPIN or by any other means available on the pop Application.

(d) Certain functionalities on the pop Application require access to information and/or components on the Customer’s Device to be operational. By using such functionalities, the Customer consents to access to such information and/or components on the Customer’s Device by the pop Application, as may be necessary for the proper operation of those functionalities. The Customer may manage access to the Customer’s Device and to information and/or components on the Customer’s Device through the privacy settings available on the Customer’s Device.

(e) The use of and/or downloading of any file or software from the Internet shall be at the Customer’s own risk and be subject to the terms and conditions imposed by the licensor of that file or software which, in all cases, shall be considered as “third party”.

(f) The Customer hereby irrevocably authorises pop Team to debit the Account Number with the amount of any transaction effected through the pop Application together with any fee related thereto.

(g) By registering on pop Application, the Customer consents to the pop Application executing his requests for (1) payment, (2) viewing balance on his Account Number and (3) accessing last transactions from his Account Number as applicable and depending on availability of service offered by the relevant MauCAS participant

(h) Upon due notification by the MNOs of the deactivation of registered mobile phone number/s, pop Team reserves the right, in its absolute discretion, to amend its records accordingly without the Customer’s prior consent and terminate the Customer’s registration to the pop Application.

(i) The Customer may receive Push Notification from pop Application. pop Team has the absolute discretion in determining the contents of same. This function may be enabled or disabled by the Customer, at the latter’s own discretion, through the settings available on the pop Application.

7. Transaction

(a) The Daily Transaction Limit is set by pop Team and may be subject to change from time to time. The current Daily Transaction Limit stands at MUR 250,000/-. This Daily Transaction Limit is subject to the customer’s identity having been verified (face-to-face) following the customer’s first transaction of Rs10,000 or higher. Any transaction above the Daily Transaction Limit shall not be processed.

(b) The Weekly Transaction Limit is set by pop Team and may be subject to change from time to time. The current Weekly Transaction Limit stands at seven times the Daily Transaction Limit. Any transaction above the Weekly Transaction Limit shall not be processed.

(c) The Customer may transfer funds to any Bank Account at any time. If there is insufficient money in Customer’s Bank Account, the transaction shall fail.

(d) If, for any reason whatsoever, a transaction cannot be completed, the Customer will be notified electronically of same.

(e) When making a fund transfer, the Customer must ensure that the payee information details, including the payee’s mobile phone number, are accurate. pop Team shall not be liable to Customer for any losses incurred as a result of the mistaken fund transfer.

(f) Once completed, a transaction is final and irrevocable and pop Team shall not be liable and under any obligation to reverse such a transaction.

(g) The Customer will be able to access details of all his transaction for the past 12 months through the pop Application.

8. Responsibilities of the customer

(a) The Customer shall comply with and not contravene any laws, rules and regulations applicable in the Customer’s jurisdiction and in the Republic of Mauritius, including but not limited to any legal requirement pertaining to the prevention of Money Laundering and Combatting the Financing of Terrorism, as may be amended from time to time.

(b) The Customer shall ensure that the pop Application is not used for any illegal, unlawful, or fraudulent activities or in any way that could damage, disable, overburden, impair or compromise the pop Application, pop Merchants, systems or security of the pop Team or interfere with other Customers.

(c) The Customer shall not collect, collate or harvest any information or data from the pop Application or attempt to decipher any transmissions to or from the servers running the pop Application or attempt to use such information or data to create, amend or update his/her records or for any commercial or non-personal use such as marketing or promotional activities or sharing with someone else, without the prior written authorisation of the pop Team.

(d) The Customer shall ensure that all details, including but not limited to the Account Number, the account number of the recipient and amount involved, entered by the Customer for any particular transaction on the pop Application are accurate and complete.

(e) It is the sole responsibility of the Customer to examine the transactions posted on his transactions listings on the pop Application and to promptly notify pop Team of any unauthorised transactions.

(f) pop Application provides the Customer with access to the Customer’s Account Number. Therefore, the Customer is recommended to keep the Customer’s Device secured and to close the pop Application when not using it to prevent accidental/unauthorised fund transfer from Customer’s Account Number.

(g) The Customer shall be liable to pop Team for any transaction effected through the pop Application by any third party who gained access of the Customer’s Device, whether with or without the Customer’s consent and/or authorisation, until the Customer notifies the pop Team, through pop Support, of such unauthorised use/access of the Customer’s Device.

(h) If the Customer suspects that a third party has become aware of the Customer’s security details, including but not limited to the Customer’s Login Password or mPIN for the pop Application, the Customer must immediately change these security details or alternatively, contact pop Team for assistance. In case the Customer fails to take such remedial actions, the Customer shall be liable to pop Team for any transactions effected from his Account Number via the pop Application.

(i) The Customer is solely responsible for informing pop Team of any change in the Customer’s mobile phone number originally communicated to and registered with pop Team and pop Team shall not be held liable for any matter resulting from the failure of the Customer to do so.

(j) The Customer understands and agrees that in order to access the pop Application effectively, the Customer shall:

i. obtain and maintain the appropriate hardware components (including but not limited to cameras) and software on the Device; and

ii. duly consult the Help Centre in order to take cognizance of the various materials regarding the use of the pop Application, which may be amended from time to time without prior notification, and ensure compliance therewith.

9. Limitation of liability

(a) Any data received by pop Team and which has been authenticated by means of any static password or mPIN or OTP on pop Application shall be duly relied upon by pop Team as being duly authenticated by the Customer. pop Team may accept as valid and duly authorised by the Customer any form of instruction, data and/or message received through pop Application. Such instruction, data and/or message shall be binding on both the Customer and pop Team.

(b) In case of receipt of any payment or transfer instructions, pop Team shall be under no obligation to match the beneficiary’s credentials with the details provided by the Customer. In case of any discrepancy, the destination account number, as instructed by the Customer, shall prevail.

(c) pop Team shall not be bound to effect any payment in accordance with any instruction received through the pop Application, unless the transaction amount is available on the Account Number and sufficient funds for payment of any related fees and charges are available in the relevant Account Number from which the Customer has requested pop Team to debit the said funds, and provided the Daily Transaction Limit and the Weekly Transaction Limit have not been exceeded.

(d) The Customer’s instructions are irrevocable and unconditional and cannot be altered, modified, amended, restrained or extended by the Customer, once same has been sent through the pop Application.

(e) The Customer agrees that pop Team shall not, in any circumstance, be bound to ensure that the payment to, or receipt of funds from a third party can be effected at any particular time or within any particular time limit.

(f) pop Team reserves the right, at any time, to reject any transaction or stop providing any particular service from the pop Services or deregister the Customer from the pop Application without prior notice if pop Team suspects that such transaction is or such service or the pop Application is being used in a manner which is in breach of the present Terms and Conditions or any other term or condition to which is subject the said particular service or any legal or regulatory requirement, whether in the Customer’s or the recipient’s jurisdiction or in the Republic of Mauritius, without incurring any liability.

(g) pop Team shall not be bound to inquire into the identity or authority of the person using the Login Password, mPIN or OTP to access the pop Application and avail himself of the POP Services.

(h) The Customer further formally and irrevocably agrees that the Customer shall defend and hold harmless pop Team and pop Team’s holding companies, affiliates, representatives, directors, officers, employees, agents, successors and assigns from and against any and all claims, liabilities, demands, actions, proceedings, suits, judgments, losses, damages, prejudices, expenses, costs, interruptions, delays or non-performances arising out of:

i. any breach of the present Terms and Conditions by the Customer; or

ii. any failure by the Customer to follow the security procedures referred to under the present Terms and Conditions; or

iii. any contravention of any law or regulation by the Customer in using the pop Application; or

iv. any inaccurate data or information furnished by the Customer during registration on the pop Application; or

v. any possession, use, abuse, misuse or manipulation by the Customer of any third party software or the unsuitability, non-performance or risk aspect of such software; or

vi. unavailability or disruption of the pop Services as a result of the acts and doings and/or omissions on the part of the Customer ; or

vii. any consequential, indirect or circumstantial losses, including but not limited to loss of profits, contracts or financial losses, howsoever caused or arising; or

viii. any failure or malfunction of any hardware or software used by the Customer to access the pop Services; or

ix. unauthorised access to the Customer’s account on the pop Application; or

x. the use, misuse, abuse, malfunction or failure of the Customer’s internet access or hardware; or

xi. the execution of or failure to execute any instruction, data and/or message received by pop Team through the pop Application; or

xii. any transaction effected by the Customer through the pop Application, including but not limited to purchase of goods and services; or

xiii. the non-receipt or delay in receipt of any good or service purchased through the pop Application or any dispute related thereto; or

xiv. any other matter relating to the access to or use of the pop Services on the pop Application; or

xv. any dispute arising between the Customer and Merchant or any third party; or

xvi. any dispute arising between the Customer and Loyalty Oneworld (Mauritius) Ltd.

10. mPIN

(a) The mPIN is required to login on the pop Application and carry out transactions. The Customer shall, in all circumstances, keep the Customer’s mPIN strictly confidential and not impart it to any third party.

(b) In the event the Customer’s mPIN has become known to any third party or is otherwise compromised, the Customer shall immediately inform pop Support to that effect and proceed to forthwith change his mPIN.

(c) The Customer shall have the possibility to change the Customer’s mPIN on the pop Application.

(d) pop Team shall never contact a Customer to request the Customer’s security credentials, including but not limited to the Customer’s Login Password, User ID, mPIN or OTP. If the Customer receives such a request, the Customer shall not, in any circumstance, disclose the Customer’s security details. The Customer should also immediately inform pop Support of any such request. In case the Customer discloses the Customer’s security details to any third party, the Customer shall be liable for the use of the Customer’s security credentials and all transactions performed through the pop Application following such disclosure.

(e) If the Customer suspects or becomes aware that a third party is aware of his mPIN or other security details, he shall immediately change his mPIN and/or contact pop Support for assistance. If the Customer fails to do so, he shall be liable for any unauthorised transaction effected on his pop account.

11. Biometric ID service

(a) In addition to all the other terms and conditions laid down under the present Terms and Conditions, the specific terms and conditions under this Clause shall also apply to and regulate the use of biometric authentication for accessing the pop Application and any other services/transactions that may be provided/completed through the Biometric ID Service. The use of the Biometric ID Service on the pop Application is subject to the acceptance of the present Terms and Conditions by the Customer.

(b) The Customer acknowledges and agrees that in order to use the Biometric ID Service:

i. The Customer must be registered on the pop Application;

ii. The Customer consents to pop Team accessing and using the biometric data stored on the Customer’s Device for the provision of the Biometric ID service;

iii. The Customer shall possess a Device featuring a biometric sensor or a biometric scanner, which shall have the ability to capture and store biometric data;

iv. The Customer shall activate and register the biometric recognition features on the Customer’s Device;

v. The Customer must ensure that only the Customer’s biometric data is stored on the Customer’s Device and understands that following the completion of the registration process, any biometric data that is stored on the Customer’s Device can be used to access and use the pop Application and pop Services.

vi. The Customer shall be responsible for the safeguard of the security code, password and all other security credentials that can be used to register the Customer’s biometric data on the Device.

(c) After the Customer’s successful activation to the Biometric ID Service, the Customer has the option to access the pop Application by either using the Customer’s mPIN or by using his biometric data.

(d) Any transaction performed or instruction provided to pop Team on the pop Application through the use of biometric data registered for the Biometric ID Service shall be deemed to have been performed or provided, as the case may be, by the Customer.

(e) The Customer acknowledges that the pop Application performs the authentication process by interfacing with the biometric authentication module available on the Customer’s Device and that the Customer agrees to such authentication process. The Customer understands that the biometric authentication module of the Customer’s Device is not provided by pop Application, and as such pop Team makes no representation or warranty as to its security aspect, conformity or interoperability with the specifications of the manufacturer of the Device.

(f) The Customer may, at any time, deactivate the Biometric ID Service through the pop Application.

If in the Customer’s knowledge, the security of the Customer’s biometric data or other security credentials has been compromised, the Customer shall immediately

(a) inform pop Team of this incident, (b) change those security credentials, (c) re-register the biometric data, (d) cease the use of the Biometric ID Service, (e) or take such other measures as pop Team may direct the Customer to minimize the risk of unauthorised use of the pop Application.

(g) The Customer understands the need to protect the Customer’s Device and shall be responsible for all transactions effected through the Customer’s Device on the pop Application (whether authorised by him or otherwise).

(h) pop Team does not represent or warrant that the Biometric ID Service shall be accessible at all times, or function with any electronic equipment, software, infrastructure or other electronic payment services that pop Team may offer from time to time.

(i) In the event of any inconsistency between the terms and conditions under this clause and the other terms and conditions laid down under the present Terms and Conditions, the former shall prevail.

12. Payment through QR Code

(a) The QR Code Reader shall be available to the Customer through the “Scan to Pay” module and the pop Application’s home screen and can be used in relation to Merchant payment and peer-to-peer payment.

(b) The use of the QR Code Reader is subject to the acceptance of the present Terms and Conditions by the Customer.

(c) The QR Code Reader shall work in conjunction with the camera of the Customer’s Device.

(d) The QR Code Reader shall decode the name of the payee and the latter’s banking details for payment purposes.

(e) In addition to all other responsibilities laid down under the present Terms and Conditions, the Customer shall also assume the following responsibilities in respect of the use of the QR Code Reader:

i. The Customer shall be responsible for getting accustomed to the use of the QR Code Reader.

ii. The Customer shall be responsible for the correct maintenance of the Device used in relation to the reading and processing of the QR Code.

QR Code Reader:

i. pop Team shall not be liable for any defect in the QR Code Reader and/or QR Code and of the consequences thereof, except for gross negligence or wilful misconduct on its part.

ii. pop Team shall not be responsible for ensuring the suitability of the camera of the Customer’s Device with regards to the reading of a QR Code.

iii. pop Team shall not be liable, in any circumstances whatsoever, for any loss or damage that the Customer may suffer as a result of the possession, use, misuse, abuse or any form of manipulation of the QR Code Reader, or any instruction received by pop Team for the completion of a transaction initiated through the use of the QR Code Reader on the Customer’s Device.

13. Video tutorials

All video tutorials are for illustrative purposes only. pop Team makes no representations or warranties of any kind, expressed or implied, about the completeness, accuracy, reliability, suitability or availability of the video tutorials or the information, products, services or related graphics contained in the video tutorials for any purpose. Any reliance placed by the Customer on such video tutorials is strictly at the Customer’s own risk. pop Team reserves the right to change and/or amend any of the video tutorials at any time without prior notice to the Customer.

14. Protection of data

i. registering your account number on pop Application to execute your requests for (1) payment, (2) viewing balance on your account number and (3) accessing last transactions from your account number as applicable and depending on availability of service offered by the relevant MauCAS participant;

ii. considering whether to approve and/or processing the Customers request through pop Services;

iii. offering, providing and making available pop Services to the Customer;

iv. performing its obligations under the terms and conditions herein;

v. carrying out identification checks, due diligence and other checks, screenings and verifications (including money laundering and fraud);

vi. Legal and Regulatory compliance (including disclosure to all government authorities and regulators);

vii. marketing purposes; and

viii. other legitimate business purposes.

(b) Transferring to its agents, banks and other authorised persons for the purpose of providing pop Services and legitimate business purposes.

(c) Customers’ data and/or information is otherwise not disclosed to third parties, save where required or permitted by law.

15. Addition of a joint account holder

(a) In the event the Customer links a joint bank account to the pop Application, pop Team shall record that any one of the joint account holders may individually operate the account on the pop Application.

(b) All obligations, undertakings, responsibilities and liabilities of the Customer under the present Terms and Conditions shall “ipso facto” be construed as being “joint and in solido” between the joint account holders and any reference herein to the Customer shall mean a both of them.

16. Loss or theft of the device

(a) The Customer shall immediately notify to pop Team any loss, theft or suspected theft of the Customer’s Device. In this case, pop Team may require the Customer to report same to the Police and to supply to pop Team proof that such report has been made.

(b) In case of dispute as to the effective time and date of notification of any loss, theft or suspected theft to pop Team, the time and date of receipt of the notification by pop Team shall be conclusive.

(c) pop Team shall, in no circumstances whatsoever, be held liable for any loss or damage resulting from any notification made by phone, email or otherwise which might not emanate from the Customer.

(d) For the avoidance of doubt, notification of the loss, theft or suspected theft of the Customer’s Device to pop Team shall, in no way, affect any transaction effected or settled by pop Team or debited to the Customer’s Bank Account prior to receipt of such notification by pop Team.

17. Loyalty programme

(a) By registering to pop Application, the Customer shall have the option to subscribe to the loyalty programme of Loyalty Oneworld (Mauritius) Ltd by clicking on the relevant tick box when registering with pop Application. The loyalty programme entitles the Customer to obtain rewards as per the terms and conditions of Loyalty Oneworld (Mauritius) Ltd.

(b) The Customer understands that subscription to the loyalty programme is optional. To subscribe to the loyalty programme, the Customer will have to tick the appropriate check box. At any time thereafter, the Customer may opt out of the loyalty programme.

(c) The Customer hereby understands and agrees that by subscribing to the loyalty programme, the Customer shall agree to be bound by:

i. The Terms and Conditions of Loyalty Oneworld (Mauritius) Ltd available

ii. The Privacy and Cookies Policy of Loyalty Oneworld (Mauritius) Ltd available

(d) By subscribing to the loyalty programme, the Customer allows pop Team to share his personal information with Loyalty Oneworld (Mauritius) Ltd such as the basic information collected by pop Team upon registration. The Customer also understands and agrees that Loyalty Oneworld (Mauritius) Ltd may also share information on the Customer with pop Team.

(e) In the event of cancellation or de-registration, the Customer’s participation to the loyalty programme shall be terminated. Upon termination, he shall not be entitled to any of the benefits and rewards accumulated, even if he re-registers on pop Application.

18. Intelluctual property rights

(a) For the purpose of the present Terms and Conditions, the term “Intellectual Property Rights” refers to all existing and future software, designs, trademarks, discoveries, formulae, processes, techniques, trade secrets, inventions, improvements, ideas, business plans, strategies and patentable or copyrightable works and all materials, of any nature whatsoever, provided or developed by pop Team, including all the rights to obtain, register, perfect and enforce these proprietary interests.

(b) No Intellectual Property Rights, of any nature whatsoever, shall be transferred from pop Team to the Customer in the course of performing any obligations or otherwise under the present Terms and Conditions. All Intellectual Property Rights shall be the sole and exclusive property of pop Team, its successors and assigns.

(c) The Customer shall not do or fail to do any act which would or might prejudice the Intellectual Property Rights of pop Team.

(d) The responsibility to ascertain the legality of the use of any “third party software” by the Customer for the purpose of accessing the pop Services on the pop Application shall rest solely upon the Customer.

(e) All rights and obligations under the present clause shall survive the discontinuation of the provision of the pop Services to the Customer, for any reason whatsoever.

19. Commission, fees and charges

(a) The Customer shall pay all the commission, fees and charges applicable for the pop Services and/or the pop Application, available on the pop’s website and which may be varied from time to time. Such commission, fees and charges shall also be varied if the Customer agrees to use additional services subsequent to the date of this Agreement. Any additional charge in respect of such additional service shall be due and payable on the date of its notification to the Customer.

(b) The payment of the applicable commission, fees and charges shall be effected exclusively through the debit of the Customer’s Bank Account, which the Customer has indicated for this purpose, by Pop Team. So long as the Customer is registered on the pop Application, the Customer shall neither revoke this authority to debit the Customer’s said Bank Account nor close the latter, without the formal written consent of pop Team.

(c) In case of any delay or default in payment of the applicable commission, fees or charges on the due date by the Customer, pop Team shall be entitled to charge interest thereon at the rate of 3% per annum over and above the Prime Lending Rate prevailing at Bank One at the effective date of the delay or default in payment.

20. POP SAVE

(a) The money that is saved by POP users will be deposited into their POP savings accounts opened at Bank One.

(b) These savings accounts will be opened on Bank One’s core banking system.

(c) POP savings accounts will ONLY be accessible through POP.

(d) POP savings accounts will ONLY allow for inward and outward self-account transfers.

(e) POP Save transfers shall be subject to Daily Transaction Limit and the Weekly Transaction Limit set up for Pop application.

(f) In case of cash out, Customers shall have the option to either partly or fully withdraw funds from their Pop Save account.

(g) In case of any closure proceed request of which the value exceeds the Daily Transaction Limit or Weekly Transaction Limit, the cashing out shall be processed by the POP Team within a maximum delay of two working days.

(h) POP users shall receive automated notifications throughout the savings journey to encourage savings habits, celebrate goal achievements and/or inform users in case of failed transfers.

(i) Should the POP savings account become inactive, account will be closed before reaching dormancy stage and balance will be automatically transferred to the POP user’s registered bank account on POP.

(j) All other terms and conditions applicable to POP Save are the same terms and conditions that are applicable to the Bank One Savings Account. The Savings Account terms and conditions are therefore incorporated hereto by reference. The Savings Account terms and conditions can be viewed at Terms & Conditions.

21. POP Insure

(a) POP Insure offers quotation comparison services in relation to a number of insurance products and services.

(b) Bank One is duly licensed, registered and qualified to act as Insurance Agent in accordance with our Insurance Agent Licences issued by the Financial Services Commission.

(c) All quotes that are generated are based on the information provided to Bank One and do not constitute a contract or binding agreement to provide insurance coverage. Any coverage descriptions provided on the Services are general descriptions of available coverages and are not a statement of contract. In order to obtain coverage, POP users must submit an application to Bank One. All applications are subject to underwriting approval by the relevant insurer.

(d) Any insurance purchasing decisions, such as coverage amounts, limits and deductibles, are completely and solely responsibility of POP users. Insurance coverage and our performance under the insurance policy of POP Users are determined solely by the terms, conditions, exclusions and limitations of your purchased insurance policy and applicable law.

(e) By using POP Services to purchase insurance, POP Users declare that all particulars stated in the application process are true and complete to the best of their knowledge and that no information has been withheld or suppressed. POP Users represent that all statements made in the application process and the terms and conditions of the policy in use by the insurer shall be the basis of any contract between POP Users and the relevant insurer. POP Users hereby authorize the insurer to investigate any qualifications stated or other statements made during the application process.

(f) Before purchasing the insurance policy, it is extremely important that all the information the insurance company holds on POP Users is accurate. Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent act as per the insurance act, which is an offence and subjects that person to legal proceedings.

(g) The POP App may contain links to independent third party websites or other applications (“Third Party Sites”). Third Party Sites are not under Bank One’s control, and POP Users agree that Bank One is not responsible for and does not endorse or monitor their content or privacy policies (if any). Bank One expressly disclaims any liability for loss or damage sustained by the POP User as a result of the accessing and use of Third Party Sites.

(h) It is important that POP Users read the insurance company’s terms and conditions to check that they understand and agree with them. The insurance company’s terms and conditions are not the same as Bank One’s and they will be the terms POP Users agree to when a quotation is accepted.

22. COMMUNICATION OF INFORMATION TO THIRD PARTIES

In case of any improper or fraudulent use of any of the POP Services by the Customer, POP Team shall, subject to applicable laws and regulations of the Republic of Mauritius, be entitled to communicate to any supervisory, investigatory or regulatory authority or any law enforcement agency any such information relative to the Customer, as may be required.

23. Force majeure

(a) For the purposes of the present Terms and Conditions, “Force Majeure Event” refers to fire, storm, flood, epidemic, pandemic, explosion, vandalism, sabotage, strikes or other labour disputes, whether involving pop Team and/or Bank One’s employees or not, acts of God, war, riots or other civil disturbances, intervention of any government or other authority, failure of or fluctuation in power supply, failure or breakdown of any machine, data processing system, transmission link or any medium of access to the pop Application or other reasons of like nature which are beyond the control of pop Team.

(b) pop Team is not responsible for any failure or delay to perform its obligations as to the pop Application or the pop Services by reason of a Force Majeure Event. When the Force Majeure Event ceases, pop Team shall, as soon as reasonably practicable, recommence the performance of its obligations as to the pop Application or the pop Services.

24. Variation to the present terms and conditions

(a) pop Team reserves the right to vary the present Terms and Conditions, which includes but is not limited to the modification, amendment, alteration, restraint or extension of any of the pop Services, subject to a prior notice of thirty (30) days, by such means as pop Team may deem fit, to the Customer.

(b) pop Team shall not, in any circumstances whatsoever, be liable for any costs, expenses or liabilities incurred or which may be incurred by the Customer in the event of any such variation of the present Terms and Conditions.

25. Cancellation and de-registration

(a) pop Team shall be entitled to cancel the Customer’s registration to the pop Application by giving thirty (30) days’ prior notice to the Customer, without being under the obligation to assign any reason thereto.

(b) pop Team also reserves the right to cancel the Customer’s registration to the pop Application if the Customer fails to log in to the pop Application for a period of twelve (12) consecutive months.

(c) However, in the event of any breach of the present Terms and Conditions by the Customer or failure by the Customer to maintain the latter’s account on the pop Application to the full satisfaction of pop Team, pop Team shall be entitled to cancel the Customer’s registration to the pop Application forthwith, without any judicial or extrajudicial action.

(d) Cancellation of the Customer’s registration to the pop Application, howsoever occasioned, shall not prejudice or affect any accrued rights or liabilities of either pop Team or the Customer hereunder nor shall it affect any provision which is intended to survive the cancellation, termination and/or de-registration of the Customer’s registration to the pop Application.

(e) At any time, the Customer may de-register from pop Application, without the need to give notice nor assign any reason thereto.

26. Waiver

No failure to exercise and no delay in exercising any right, power or privilege under the present Terms and Conditions shall operate as a waiver thereof nor shall any single or partial exercise of any right, power or privilege preclude the enforcement of any other right, power or privilege. No waiver of any breach of any provision under the present Terms and Conditions shall be taken or held to be a waiver of any subsequent breach of such provision or to be a waiver of the provision itself. No waiver shall be effective unless duly executed in writing.

27. Assignment

The Customer shall not assign any of its rights or obligations in the present Terms and Conditions, in any circumstances whatsoever, without the prior written consent of pop Team to that effect.

28. Severability

Should any provision of the present Terms and Conditions be declared void or unenforceable by any competent authority or court, the remaining provisions which are capable of severance from the defective or unenforceable provision shall continue to be in full force and effect, provided that these remaining provisions are not deprived of the initial intended purposes of the present Terms and Conditions.

29. Governing law and applicable jurisdiction

(a) The present Terms and Conditions shall be governed by and construed in accordance with the laws of the Republic of Mauritius and any dispute arising in connection with the interpretation and/or fulfilment of the present Terms and Conditions shall be submitted to the exclusive jurisdiction of the competent courts within the Republic of Mauritius.

(b) The Customer shall be liable for any use or export by the Customer of any of the Customer’s information on the pop Application, in contravention with any local or national laws of the country from which the Customer is operating the pop Application.

30. Customer’s acknowledgment and declaration

(a) The Customer acknowledges that the Customer has read and understood the present Terms and Conditions and agreed to be bound by the latter.

(b) The Customer further acknowledges that the Customer has taken due cognizance of the Bank’s Privacy Policy and Feedback and Complaints page available on pop’s website.

(c) The Customer declares and warrants that all information provided to pop Team for registering the Customer to the pop Application is up-to-date, true, complete and accurate to all intents and purposes. In case of any change in any information provided by the Customer to pop Team, the Customer shall, within three (3) working days of such change, inform pop Team accordingly.

Last updated: 19 May, 2025