How will Bank One adapt its operations now that the Central Bank has launched the MauCAS, a platform that will make instant bank transfers a reality?

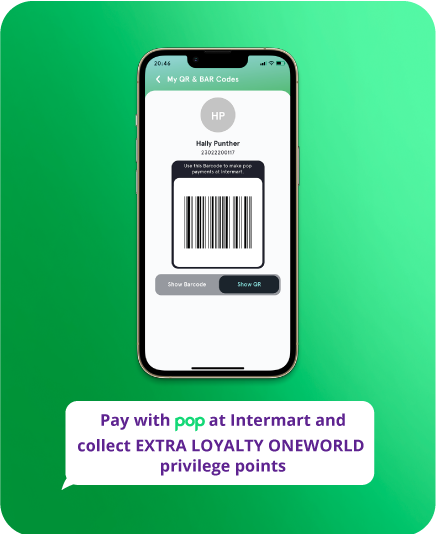

We are delighted with the launch of MauCAS, which will make banking, e-commerce, and mobile payments inter-operable. Over the past few months, we have been working closely with the Bank of Mauritius to develop a new payment solution, branded ‘pop’ and which will be a natural extension of the MauCAS Instant Payment Infrastructure. The primary purpose of pop is to offer a totally universal solution to all Mauritians for their daily payments. In other words, pop will enable any person with an account in any bank to sign up easily and use it to make payments to any person in any other bank or pay a merchant or a bill using a QR code or a phone number. Pop users will not be required to open an account or a wallet with Bank One. Payments are safe, instantaneous and at no cost (via a smartphone phone) and give users access to a range of exciting rewards. By accepting pop payments, merchants too will benefit from a massive reduction in their interchange costs, which will allow them to offer better services to their customers. Pop will be live this week and we are excited to help transform how Mauritians do payments!

What are the key features of pop? How will they meet the expectations of your target market when taking into consideration the continuous shift to digital payments?

We carried out thorough and detailed market research when developing pop, including focus groups, and a key insight that kept coming out was that users welcome the concept but don’t want to go through the effort of opening new accounts. We also noticed that people may or may not carry their wallet but will always have their mobile phone with them. To date, there is no agnostic payment solution in Mauritius. The availability of such an application will enhance user experience as users will be able to manage their payments from all their bank accounts through a single mobile application whereas, until now, they have had to use mobile banking applications from multiple banks depending on the specific transaction. Other features include the ability to split the bill with others across banks, request payments and enjoy rewards from a selection of outlets. Over time, we plan to bring new features to pop including easy digital purchase of insurance, loans, savings, among others, from a range of partner providers.

Is Mauritius ready to adopt this mode of payment?

Absolutely yes. Since 2020, the successive lockdowns have shown that Mauritians are keen to adopt digital channels for payments – we saw a starling increase in the use of mobile banking, internet banking and contactless payments in stores. Global trends show that such payment forms help accelerate the move towards a cashless society with all its ensuing benefits and, in several countries, they account for almost a third of retail transactions. We firmly believe that Mauritians too are embarking on that journey – and the new MauCAS capabilities make it convenient for both users and merchants through the standardisation and interoperability of QR codes. That said, it is not going to be an easy journey – once the early adopters are signed-up and active, others will need more education on the benefits and the experience will need to be frictionless for mass adoption.

With the changes, which will accelerate the evolution of the overall banking sector, what is the key role that Bank One is playing/will play in terms of innovation?

Our mission is to have pop available to every single Mauritian with a smartphone and for every merchant to be able to lower their transaction costs by accepting pop payments. We are building pop with an ethos of always being open architecture and bank-agnostic – that is, it’s designed as a universal payment solution which enables all users (not just Bank One customers) to enjoy the benefits of instant payments. But that is just the tip of the iceberg – under that same ethos, we will partner with an ecosystem of financial services firms and fintechs to continue delivering new delightful experiences and uniquely cater for their unmet needs. For pop merchants, in addition to substantially lowering transaction costs, we will give them access to a range of additional services that helps them build loyalty with their customers, simplify the entire billing process and enable seamless reconciliation of transactions.

How is this translate into long term actions? What’s next for pop?

There is a lot more down the pipeline soon and our hope is that every few months we will be able to offer new features to pop users. In addition to payments, pop will progressively enable users to access a whole range of other financial services that will help them get closer to their financial hopes, dreams and ambitions.