We get it—you’re excited about your trip, you’ve packed your bags, double-checked your itinerary, and you’re ready to go. But, hold on… did you remember to get travel insurance? If you’re tempted to skip it to save on a few bucks, think again! Traveling without insurance might seem like a...

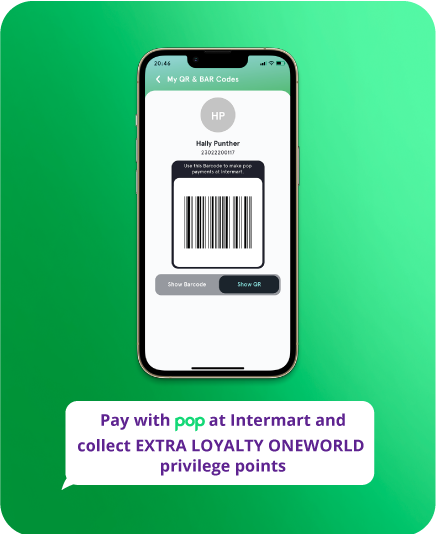

Don’t miss out on pop’s latest features! Get to know pop inside and out, and unlock its full potential. Say yes to innovation, say yes to cashless, contactless, mobile payments. Subscribe and have a good read!

You’re scrolling through Instagram, and there they are: your friends, soaking up the sun on a tropical beach, cocktail in hand, while you’re at home, trying to make sense of your budget. It’s natural to feel a little envy—but here’s the good news: you *can* travel too without maxing out...

Have you always been good at saving, or are you thankful that POP Save came into your life?Before POP Save came into my life, I was never really good at saving money. It always felt like I was trying to hold water in my hands – no matter how hard...

Are you finding it challenging to save money these days? Does it seem like no matter how hard you try, there's always something that eats into your savings, especially when you work in Port Louis, where tempting food and shops are everywhere? It's a struggle many of us face. But...

Hello, fellow adventurers! POP here, and I’ve got some incredible news straight from the land of Bollywood, bustling bazaars, and delicious butter chicken. I’ve been busy exploring India, and guess what? I’ve brought back something special just for you – UPI, i.e. the ability to pay in India directly from...

Father's Day is just around the corner, and it’s time to show Dad just how much he means to you. Whether you're working with a tight budget or ready to go all out, we've got the ultimate gift guide to make your dad feel like the king he is. From...