Have you always been good at saving, or are you thankful that POP Save came into your life?

Before POP Save came into my life, I was never really good at saving money. It always felt like I was trying to hold water in my hands – no matter how hard I tried, it just slipped through my fingers. But then POP Save came along and changed everything for me. I’m so thankful for it because it helped me save in ways I never thought possible. Now, I can see my savings grow, and it feels incredible!

How did you feel when you realized you had saved enough for your trip to Rodrigues using POP Save? Can you describe that special moment?

When I realized I had saved enough for our trip to Rodrigues using POP Save, I was ecstatic! This special moment happened on our first civil wedding anniversary, making it even more memorable. It felt like the perfect gift for both my husband and me. Saving enough money to go to Rodrigues to celebrate our anniversary in such a beautiful place made it even more incredible. It was the best anniversary gift we could have ever given ourselves!

How did you plan and manage your savings with POP Save for your Rodrigues trip? We’d love to hear your story!

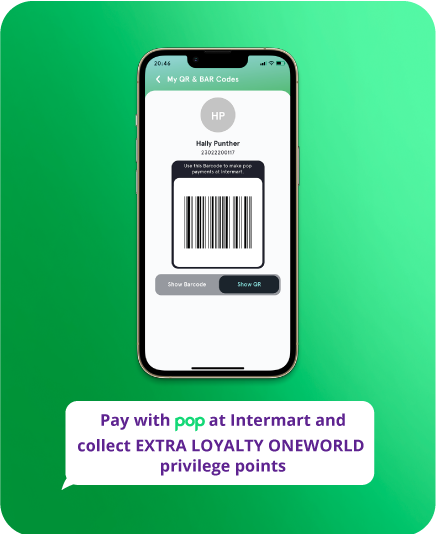

Planning and managing my savings for the Rodrigues trip with POP Save was a bit of an unplanned adventure! I was using the Goals rule-based savings feature, where POP Save automatically set aside a percentage of my salary each month. I didn’t even realize how much had accumulated until I checked and saw that I had enough for the trip. It was a delightful surprise! When I saw the total, I seized the opportunity to book our trip to Rodrigues. POP Save made saving effortless, and it was like discovering a hidden treasure when I found out we could finally go on that dream vacation.

How has your experience with POP Save changed the way you plan and save for the future?

My experience with POP Save has truly transformed the way I plan and save for the future! Before using POP Save, saving felt like a constant struggle, and I often found myself falling short of my goals. But with POP Save, the process became so much easier and more intuitive. The automated savings feature takes a percentage of my salary each month, making saving a seamless part of my routine. Now, I feel more confident and proactive about my financial goals. I can set specific goals for different needs, like vacations, emergencies, or big purchases, and POP Save helps me stay on track effortlessly. It’s like having a personal savings assistant that ensures I’m prepared for whatever the future holds. This has not only given me peace of mind but also empowered me to dream bigger and plan smarter for what’s ahead.

What tips would you give to others thinking about using POP Save for their own savings goals?

Set clear goals for what you want to save for, whether it’s a vacation, an emergency fund, or a big purchase. Having specific goals will keep you motivated and focused. Remember, saving isa gradual process, so be patient and trust that consistent contributions will accumulate over time, even if progress seems slow at first.