Contactless card payments have been around for a few years in Mauritius and have gained significant traction since the start of the Covid-19 pandemic. Smartphones are now joining the party too! Bank One announced today that it has added NFC mobile payments as a new feature to its pop payment app. It is yet another first for the universal payment app that is only a few months old but aspires to change the way people pay and get paid in Mauritius!

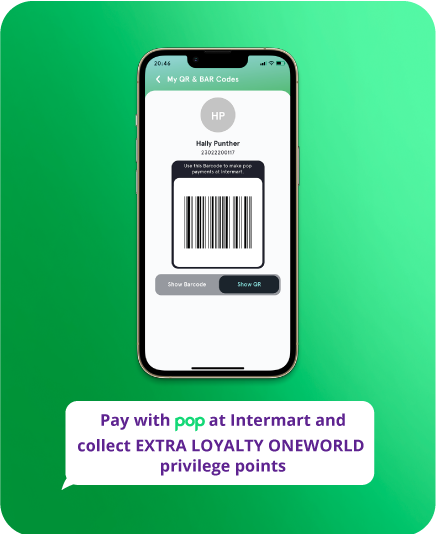

Pop users are now able to make payments to individuals and merchants with a simple tap of their smartphones thanks to Near Field Communication (NFC) technology. NFC technology allows data to be transmitted over a short distance between devices enabling a smartphone to work like a contactless card.

How does it the benefit the user? Transactions no longer require the sharing of a bank account or a phone number be it with a merchant or an individual. Once configured, the user only has to bring his phone near the beneficiary’s phone (peer-to-peer transaction) or the payment terminal (peer-to-merchant payment) and choose the bank account to be debited. Currently available on Android, the “Tap & Pop” feature will soon be made available to IOS users too.

“We have reached an important milestone with the launch of the NFC feature. Pop was launched with a clear vision to facilitate access to instant and low-cost services for all Mauritians, starting with instant payments across banks. With NFC, we want to make transactions even easier and more convenient. Bank One is proud to be behind this revolution! We look forward to announcing more exciting features in the near future and we would like to thank our partners for their trust and our teams for their dedication,” says Eric Hautefeuille, COO of Bank One.

To enable payments to merchants, pop has partnered with MiPS, a payment-driven feature-oriented platform offering disruptive processes to companies. Pop registered merchants are equipped with a compatible PayStation terminal from MiPS. The MiPS PayStation is a powerful little device that carries all the functionalities of a traditional POS terminal and much more. To initiate an NFC payment via pop, the merchant only needs to trigger a payment request with the required amount. Once the customer accepts the payment request on his pop app, the payment happens instantly and both the merchant and customer know that the transaction is completed within a few seconds.

“MiPS is continually pushing the boundaries to provide its merchants with faster and more secure payment methods. The ‘MiPS Tchin’ technology and its compatibility with pop, as a universal payment solution, achieves both. Shoppers can now simply bring their smartphones up to the MiPS PayStations for fast and secure bank-to-bank payments. Payments couldn’t be easier!” adds Sebastien Le Blanc, Chief Executive Officer of MiPS.