Life’s twists and turns can hit hard when we least expect it – an abrupt job shakeup, health scare, or car hiccup. To stand strong in these times of uncertainty, you need a formidable ally: the emergency fund. Join us in discovering the mighty importance of having an emergency fund, the right size to aim for, and our simple tool to shape it.

How the Emergency Fund can be a lifesaver:

- Weathering Life’s Storms: Life’s surprises strike unannounced, but the emergency fund stands like a fortress, ensuring your big dreams don’t get drowned by unforeseen waves.

- Banishing Stress: Money troubles can cloud sunny days. With an emergency fund, you can breeze through difficulties, leaving room to brainstorm solutions, not fret over finances.

- Crushing Debt Dragons: Without a lifeline, people often borrow, igniting a debt inferno. An emergency fund breaks this chain, helping you avoid the debt trap.

- Grabbing Opportunities: The unexpected can bring golden chances – like business ventures or investments. Your emergency fund empowers you to pursue these opportunities without compromising financial stability.

How much is enough for your emergency fund?

While building an emergency fund’s a savvy move, nailing the size isn’t one-size-fits-all. The rule of thumb says stash three to six months’ worth of living expenses, but adapt it to your life story:

- Monthly Must-Haves: Total up key expenses – rent, utilities, groceries, insurance, debts. Three to six months’ worth is your entry ticket.

- Job Jive: Check job stability. If your industry’s a wild ride or your income’s a rollercoaster, go for the six-month cushion.

- Loved Ones: Have dependents or thinking of growing your family? Beef up your emergency fund to cater for a safe cushion for them too.

- Safety Net Symphony: If insurance or family’s got your back, adjust the fund size accordingly.

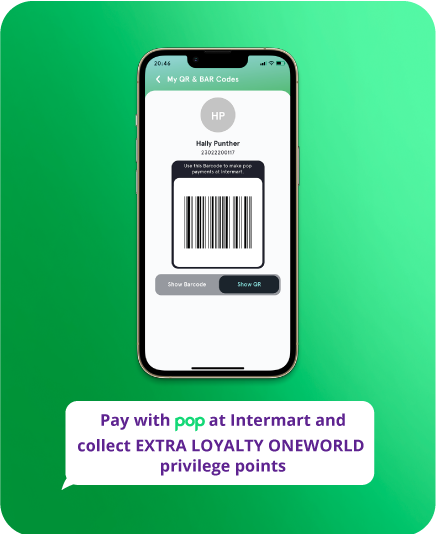

Forge Your Fund with Pop Save:

An emergency fund isn’t just a trick – it’s a superpower. Face the unknown with a grin, shielded by your financial might. Aim for that three to six months’ living expenses. And here’s the kicker: Pop Save’s here to make this journey effortless::

- Open POP & Tap on Save

- Select Smart Goal and tap on Emergency

- Name your goal as “My Peace of Mind”, set the amount you want to save and the due date

- Confirm the amount and set the date of the month to save

- Enjoy the peace of mind and invaluable financial security it brings!

Ready to sculpt your financial armor? Begin today with Pop Save, and let’s build a future ready for any plot twist!