The cashless revolution

Have you ever wondered what a cashless society would look like? One where notes and coins are out and digital solutions are in. This is indeed slowly becoming a reality. In fact, Sweden is well positioned to become the first cashless country in 2023! To date, less than 10% of its population use cash to pay for products and services. Mauritius, on the other hand, has come a long way in recent years. Today, mobile payments, e-wallets, QR codes, online payments and contactless payments are some of the solutions that form part of our everyday lives. Why? Simply because they are safer, more convenient, fast, seamless and… trendy!

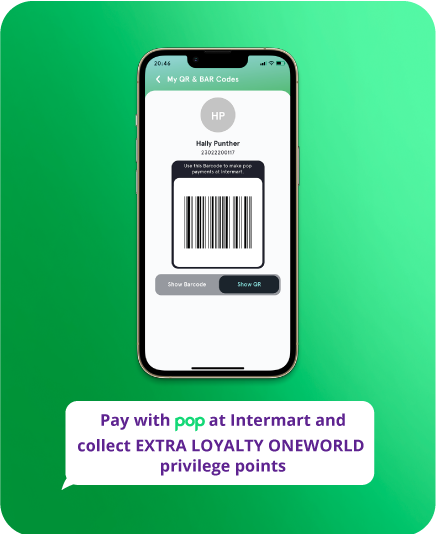

Download pop, the latest mobile payment app on the block to join the cashless revolution today.

Are you ready to embrace innovation?

For a long time, debit and credit cards have been used as the single alternative mode of payment to cash. However, on their own, they are not sufficient to build a cashless economy. Banks have long been considered late to the party when it came to digital innovation. However, they have made substantial progress over the last decade as competition came in many forms to challenge their traditional business model.

While Internet and Mobile Banking have been around for many years now, the Covid-19 pandemic has undoubtedly accelerated the shift to digital banking for customers who were initially reluctant to change the way they interacted with their bank. In Mauritius, we saw a whopping increase of 400% in e-commerce transactions and a big surge in the usage of debit and credit cards and contactless payments during the two lockdowns. Online banking solutions nowadays offer a broad range of features and the ability to perform transactions conveniently at little or no cost on a safe platform. This has clearly demonstrated that Mauritians are ready to adopt digital payments and that they would be eager to embrace new solutions. Pop brings a new feature to Mauritians today, taking local mobile banking solutions to the next level: open banking. This means that pop allows you to access all your local banks accounts in one single app, and send money instantly from any bank, to any bank.

The role of the fintech industry

A key player in the shift towards a cashless society is the fintech industry. Both China and Sweden are perfect fintech success stories. China, with its dominant platforms like WeChat and Alipay and Sweden with its international fintech companies are way ahead of most countries in the cashless trend. Even though it is still in its infancy in Mauritius, the Central Bank is putting in place the necessary infrastructure to facilitate the development of fintech in the banking and non-banking financial space. A notable achievement in this area is the implementation of the Mauritius Central Automated Switch (MauCAS) that makes banking, e-commerce and mobile payments inter-operable, and promotes a ‘cash-lite’ society. However, to accelerate the complete digitalisation of payment services in Mauritius, the Central Bank needs the support of fintech firms, banks and all stakeholders. Pop is one of the first payment solutions to be built on MauCAS. It is fully licensed by the Bank of Mauritius.

Around the world, cryptocurrencies have also been introduced in the equation and are already being used for digital transfers. Given that there are many players in the cryptocurrency market, the competition is fierce, which is one of the reasons why the cost for this type of money transfer is low. However, there is some fine-tuning in terms of risks and regulatory policies that needs to be done before making cryptocurrencies a viable alternative to cash for consumers.

What are the benefits of a cashless society?

Moving away from cash offers convenience and agility to companies, merchants and individuals in general. However a cashless society can bring other advantages such as:

A safer alternative to cash

Carrying cash makes you more vulnerable to targeted attacks and tracking cash can be a very difficult process in cases of theft. Once it’s gone, it’s gone! In a cashless society, records for tracking money are available in just a few clicks, which makes the process of resolving fraud cases more efficient. Furthermore, a study carried out by American and German researchers found that when the state of Missouri substituted cash welfare benefits with electronic benefit transfer cards, crime decreased by 9.8% in the state. Looks like we found ourselves a n° 1 reason to go cashless!

A key element in the fight against money laundering

Money laundering, which is a common issue in every society, becomes more challenging if the source of the funds is clearly determined and recorded. Illegal transactions can be easily tracked and, if every payment transactions and income are recorded, then tax evasion becomes more difficult to hide.

Cost-effective

How? Well, we never think about it but managing money is very costly! Printing bills, storing money and hiring businesses to move your or your business’ cash safely from one place to another and protecting banks against robberies involve considerable expenses. In a cashless economy, these expenditures would be non-existent.

You’re a business owner? Cut your losses today, discover pop Merchants.

What about the environmental impact?

For those of you with a green conscience, a cashless society where paper receipts are no longer needed is the utopia. In the US alone, producing paper receipts requires up to 10 million trees and about 21 billion gallons of water every year! Besides adding up to our everyday waste, they also increase our carbon footprint. Opting for cashless solutions is therefore the sustainable choice. At pop, not only are we cashless, but we also strive to be paperless! Onboarding is 100% online, no lengthy paper contracts to sign at a bank.

Did you know?

The mobile app BankID has played a major role in Sweden’s cashless transformation. With the use of a six-digit code or a fingerprint, almost everything is accessible from a smartphone in Sweden, from online banking to signing contracts. And it gets even more surreal: over a thousand of Swedes have a microchip implanted in their hand. These devices can store different kinds of data, like ID, train tickets and bank cards. Paying for everyday commodities gets even simpler with the use of these little devices: just a simple wave of the hand is needed! And it is probably what the future has in store for us too! For now, let’s get pop’in!