Instant money transfers to friends and family from any bank to any bank, free cashless payments in stores and online, splitting bills, tracking your expenses… pop is the new kid on the digital payment scene. Download pop here.

When banks around the world unveiled the first debit cards more than half a century ago, it was considered as THE big thing. Paying groceries at a POS terminal or entering a PIN code on an ATM and seeing notes coming out of a machine was a little surreal. Flash forward years later, the small plastic card is bound to disappear in the near future because so much has happened and is still happening in the banking and financial world. Today, mobile wallets, internet banking, mobile banking, digital currencies and now universal payment apps appeal to individuals, small and large businesses, investors and governments alike. Even giants like Google, Samsung, Apple, Amazon and Facebook have joined the digital payment market and provide their own solutions. And now in Mauritius, we bring you pop! So, what exactly is a digital payment, how does it function and what are the benefits?

Digital payments are financial transactions that are conducted via the Internet, a POS device, mobile channels or through apps. In other words, no cash (notes and coins) is involved in the transaction. For example, when you select a product or service on a website and pay with your credit card, this means that you have chosen a digital payment option. When you enter a coffee shop and scan a QR code with your smartphone to pay your cappuccino, you have again performed a digital payment.

Since last year, there is no denying it, we have seen a boom in cashless payment and e-commerce in Mauritius and worldwide. The health crisis has exhorted key players in the finance sector to shift to cashless payment systems. SMEs and larger operators have provided digital solutions to their customers to limit the spread of the coronavirus and pursue their commercial activities in spite of lockdowns and movement restrictions. This migration to a cashless society has in one way or another affected every individual participating in the economy. Electronic payments are convenient and can provide significant benefits to both customers and business owners.

What are the benefits of digital payment systems?

1. Cost-savings

For individuals

It’s actually free to use pop to pay in-store or online. We only charge for peer-to-peer. pop fees for transfers between banks remain much lower We’re very transparent with our pricing. Check pop Fees and Charges here.

For business owners

Processing costs for digital payments are significantly lower for business owners. You may not have realised it, but handling cash is time consuming; the shop owner needs to manually reconcile their cash earnings and transport it physically to the bank, exposing themselves to theft and loss! With digital payments such as pop, the business owner receives payment directly into his/her bank account. While they pay a small fee per transaction, they save big on time and security costs. Compared to card payments, pop is also considerably more affordable, saving businesses up to 150% on commission fees, and with zero fixed rental costs for payment terminals. Discover pop Merchants here.

2. Instant and error-free

Digital payments have made payments easier and much faster. Time or location are now irrelevant, as long as you have a smartphone, a bank account and a secured internet connection. Customers can effortlessly pay a retailer by using a mobile app such as pop at any moment, from anywhere. For an error-free transaction, both the buyer and the seller can instantly trace the transaction in their financial records with accuracy.

3. Advanced security

New technologies such as tokenization, encryption and SSL, amongst others, now offer enhanced protection for electronic payments. To complete a transactionon pop for example, you simply need to enter your PIN or a one-time password (OTP), depending on the size of your transaction. No need to share your bank orcard details. Fast and secure, what’s not to love?

4. Transparency

Electronic payment systems provide greater transparency and traceability to protect the customer whilst reducing the risk of criminal activities going undetected. Payment details can be provided to customers beforehand by the seller and both parties can view their transaction history in a few clicks in real-time. New technologies such as blockchain even go one step further in providing complete transparency whilst safeguarding the rights to privacy for the customer.

5. Contactless

The COVID-19 pandemic has made contactless payments even more attractive as a means to limit contamination from the virus. Contactless payments are fast growing in popularity as an alternative to cash. Existing contactless modes of payment include: contactless cards and terminals, scan and pay using QR codes, e-wallets and mobile payment apps. A multibank app like pop allows you to pay anyone, anywhere, anytime all while respecting health measures!

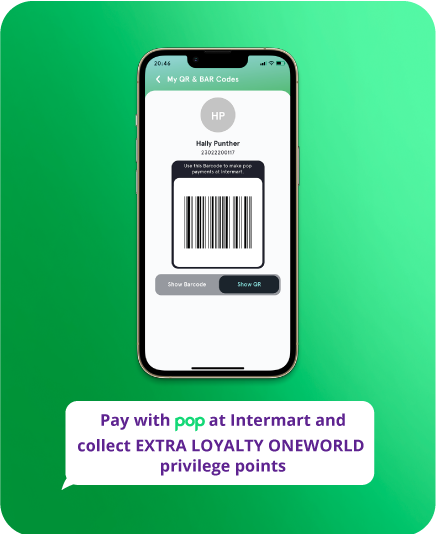

6. Rewarding

As digital payments become more mainstream, operators are going all-out to satisfy their users. Pop brings you bags full of personalised benefits and rewards such as discounts, loyalty points and cash rewards. In other words, your loyalty gets rewarded and you can earn while spending. Is this the perfect system or what?

Electronic payments have taken businesses and consumers by storm in the last few years. In contrast, cash transaction volumes have dropped as more and more people have shifted to digital modes of payment since the beginning of the pandemic. A wider choice of digital payment systems also imply greater access and affordability for businesses and consumers alike. Small businesses in particular are able to jump on the bandwagon to provide a convenient and secure method of payment to their customers. Wider acceptance, cheaper and faster transactions, special offers for both customers and retailers – without a doubt, the cashless revolution has only just started! Get started with pop now.

I was excited to uncover this great site. I need to to thank you for your time for this particularly wonderful read!! I definitely enjoyed every part of it and I have you book marked to check out new stuff in your web site.