General Conditions of Use

Introduction

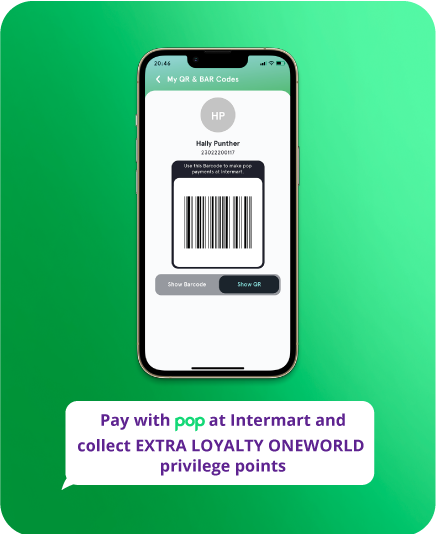

The Bank provides mobile payment services, through its mobile payment application, hereinafter referred to as “POP Service” and an acquiring platform for Merchants, hereinafter referred to as “POP Merchants” and the Merchant has agreed to the use the aforesaid POP Merchants at its business outlet or on its E-commerce portal, in accordance with the present General Conditions of Use and the Merchant Agreement.

Term and conditions

The Merchant and the Bank hereby confirm the above introduction as part of the present General Conditions of Use and agree and covenant as to the contents of the hereunder stipulated terms and conditions and shall endeavour towards their full execution, without any derogation thereof.

1. Definitions

In the present General Conditions of Use, the following words and expressions shall have the meanings stated.

Bill means a statement of money owed for goods or services delivered which is issued by a Merchant to a Customer.

Business day means a day other than Saturday or Sunday or a public holiday.

Customer means any person who has subscribed to POP Service.

E-Commerce portal means a Merchant’s electronic portal through which a Customer can purchase goods and services.

Equipment means any device, including but not limited to point of sales device, adaptor, QR code, mobile device, tablet and/or other device borrowed to the Merchant by the Bank for direct communication with the Bank’s central computer system for obtaining authorization and /or capturing transaction data.

Force Majeure Event shall have the meaning assigned to it as per Clause 9.

Outlet means the physical address or premises being the Merchant’s place of business from which the Merchant provides its business activities.

Merchant means any person, entity or trader exposing Bills for settlement through POP Service and/or accepting POP Service as a mode of payment at its outlet and/or on its E-commerce portal as outlined in Schedule 1.

POP Service means the services offered through the POP mobile application which allows Customers various payment functionalities including but not limiting to purchase of goods and services or instant transfers. POP Service can be downloaded from Play Store or the App Store.

POP Merchants means the acquiring platform accessible for Merchants to accept and manage payments through POP Service.

Service means the POP Service.

Software means the proprietary technology embedded in the Equipment.

Transaction means all legitimate business activities in the provision of goods and services by the Merchant to Customers through POP Service and/

or POP Merchants.

2. Interpretation

(a) In the present General Conditions of Use, except where the context requires otherwise:

(i) Words indicating one gender include all genders,

(ii) Words indicating the singular also include the plural and words indicating the plural also include the singular.

(iii) Any reference to a person includes, without being limited to, any individual, body corporate, unincorporated association or other entity recognised under any

(iv) law as having a separate legal existence or personality.

(b) Headings used in the present General Conditions of Use are provided for convenience only and shall not be used to construe meaning or intent.

3. Use of Software and Equipment

(a) The Bank shall provide the Software to the Merchant. The Equipment may be provided by the Bank to the Merchant. Both the Software and the Equipment which shall at all times remain the property of the Bank.

(b) The Merchant shall ensure that the equipment and/or software supplied by the Bank are not used for any unlawful purposes, improper or damaging manner and are not tampered with.

(c) The Merchant shall not displace the Equipment to another location without prior written consent of the Bank.

(d) The Merchant shall be responsible for maintaining the Equipment in good running condition. In the event of any Equipment malfunctioning, failure or other incident resulting in the loss of use of Equipment and Software or need for repair or maintenance, the Merchant should inform the Bank forthwith.

(e) Any loss or damage to the Equipment and/or Software which has arisen from or has been occasioned by any act, omission, negligence, and wrongful doing of the Merchant, its directors, employees, agents and/or any of its affiliate shall be made good or replaced by the Merchant at its own cost.

(f) The Bank reserves the right to charge the Merchant for any intervention and/or replacement of Equipment in the event of any misuse and/or tampering of Equipment/Software by the Merchant.

(g) The Merchant shall use the Software exclusively to accept payment via POP Service and shall not disclose such Software to any party, convey, copy, licence, sub-licence, modify, translate, reverse engineer, decompile, disassemble, tamper with, or create any derivative work based on such Software.

(h) The Merchant agrees that the Bank shall have the right to disconnect any Equipment or Software from the Bank’s computer system if the circumstances so warrant and the Merchant shall have no claim whatsoever against the Bank as a result of any such disconnection.

4. Reconciliation

The Merchant agrees to verify and reconcile with the Merchant’s records all statements, notifications, mails, emails, faxes or any communication material issued by the Bank with regards to settlements and crediting of processed transactions and to use the reconciliation tools provided by the Bank. The Merchant shall be responsible for communicating to the Bank in writing any discrepancy noted and shall release and hold the Bank harmless for such discrepancies or resulting liabilities and losses.

5. Intellectual Property Rights

(a) For the purpose of the present General Conditions of Use, the term “Intellectual Property Rights” refers to all existing and future software, designs, trademarks, discoveries, formulae, processes, manufacturing techniques, trade secrets, inventions, improvements, ideas, business plans, strategies and patentable or copyrightable works and all materials, of any nature whatsoever, provided or developed pursuant to the present General Conditions of Use, including all the rights to obtain, register, perfect and enforce these proprietary interests.

(b) No Intellectual Property Rights, of any nature whatsoever, shall be transferred from the Bank to the Merchant in the course of performing any obligations or otherwise under the present General Conditions of Use. All Intellectual Property Rights shall be the sole and exclusive property of the Bank, its successors and assigns.

(c) The Merchant shall not do or fail to do any act which would or might prejudice the Intellectual Property Rights of the Bank. All rights and obligations under the present clause shall survive the termination or expiry of the present General Conditions of Use, as the case may be.

6. Indemnity

(a) The Merchant shall indemnify and hold the Bank and its officers, employees, agents and independent contractors harmless from any card association fine or fee or assessment, liability, loss, damage, claim or complaint, and reasonable attorney’s fees and costs and any reasonable fee imposed by the Bank to cover the Bank’s administrative costs incurred, arising out of the Merchant’s breach of the present General Conditions of Use, including but not limited to, misrepresentation or breach of any covenants or warranties herein contained or from the Merchant’s or Merchant’s employees’ negligence or wilful misconduct.

(b) The Merchant agrees to release and hold the Bank harmless for any system downtime and/or instability that may arise from the necessity of the Bank to shutdown, restart, perform maintenance or upgrade or due to any other reason not limited to technical requirements/issues and downtimes caused by communication failures, instability, fluctuations between card associations, the Bank and the communication providers.

(c) The Bank disclaims any warranty that: (i) the Service shall be uninterrupted or error-free, (ii) that defects will be corrected (iii) that security methods employed will be sufficient or (iv) service will be correct, accurate or reliable.

(d) The Bank disclaims all other representations or warranties, expressed or implied made to the merchant or any other person, including without limitation, any warranties regarding quality, suitability, merchantability, fitness for a particular purpose or otherwise of any services or any goods provided incidental to the services provided.

(e) The Bank shall indemnify and hold the Merchant harmless from any liability, loss or damage which directly results from; (a) the Bank not complying with the terms and conditions of the present General Conditions of Use; or (b) any loss suffered by the Merchant as a result of the Bank’s negligence. The Bank shall not be liable for any special consequential, exemplary or, punitive damages. The Merchant acknowledges and agrees that the indemnity hereunder shall not extend to any act or failure to act by any employee of the Bank.

(f) Notwithstanding any other provision of the present General Conditions of Use, the aggregate liability of the Bank, its directors and employees whether in contract, tort or otherwise shall in no circumstances whatsoever exceed Rupees Hundred Thousand. The Bank shall not be liable to the Merchant or any third party for indirect or unforeseeable losses and without limitation to the generality to the foregoing, for any special consequential, exemplary or punitive damages, economic loss or failure to realise expected profits, savings or other benefits.

7. Confidentiality

(a) For the purposes of the present General Conditions of Use, « Confidential Information » refers to any data, information and/or material pertaining to the Bank and/or the Services, disclosed and/or furnished by the Bank or which may have, directly or indirectly, come to the knowledge of the Merchant or the Merchant’s representatives, directors, officers, employees, agents or assigns prior to, concurrent with or following the signature of the present General Conditions of Use, whether orally, in writing, in electronic form or otherwise, regardless of whether they are marked as being confidential or otherwise.

(b) « Confidential Information » includes but is not limited to: –

(i) Personal data, as defined under the DPA 2017;

(ii) Any data, information or material pertaining to the business, system, service, technology, operation, processes, plans, whether past, present or future, of the Bank, its holding companies or affiliates;

(iii) Any data, information or material relevant to the system of management, the specification of operation, marketing of technologies, strategy of competition, sales estimates, strategy of price, sales promotion, projections, financials, performance results, whether past, present or future, of the Bank, its holding companies or affiliates;

(iv) Any scientific or technical information, invention, design, procedure, formula, method, improvement, concept, report, know-how, trade secret or such other information of a similar nature of the Bank, its holding companies or affiliates;

(v) Any data, including special categories of personal data under The DPA 2017, information or material pertaining to the employees, customers, suppliers or service providers, whether past, present or future, of the Bank, its holding companies or affiliates;

(vi) Any data, information or material provided by the Bank for the purposes of the Services;

(vii) Any data, information or material marked as being of a confidential or proprietary nature for the Bank, its holding companies or affiliates;

(viii) The present General Conditions of Use; and

(ix) Any data, information or material that may reasonably be treated as confidential information for the Bank after due consideration of normal business practices and the particularity of any given situation.

(c) The Merchant shall use the Bank’s Confidential Information exclusively for the purpose of the present General Conditions of Use and any deviation therefrom shall require the prior written consent of the Bank’s duly authorised representatives.

(d) The Merchant shall, at all times, keep the Bank’s Confidential Information in strict confidence and shall not, without the prior written consent of the Bank, disclose the Bank’s Confidential Information, in whole or in part, in any manner whatsoever. In the event that the Merchant becomes aware of a personal data breach, it shall inform the Bank without any undue delay.

(e) The Merchant shall not, directly or indirectly, through any person or entity, undertake any manoeuvre as to the Bank’s Confidential Information with a view to reveal the source code, trade secrets, processes or any other data, information or material not expressly disclosed by the Bank to the Merchant.

(f) The Merchant shall disclose the Bank’s Confidential Information to only those of its directors, officers or employees who have a need to be possession of such Confidential Information, who have been informed of the confidential or proprietary nature of the Confidential Information and who have been accordingly instructed to use the Confidential Information solely for the purposes of the present General Conditions of Use.

(g) The Merchant shall use its best endeavours to treat and maintain the Bank’s Confidential Information in strict confidentiality, the degree of care to be used by the Merchant for such purpose shall, at all times, not be less than the degree of care used by it to safeguard its own Confidential Information.

(h) The confidentiality obligations stipulated under the present clause shall survive the expiry or termination of the present General Conditions of Use, as the case may be.

(i) Notwithstanding anything hereinbefore set out, the Merchant shall be entitled to disclose any Confidential Information, if so required by law, and shall, unless restricted by law: –

(i) Promptly notify the Bank of the existence, terms and circumstances surrounding the proposed disclosure;

(ii) Consult with the Bank on the advisability of taking legally available steps to resist or narrow such request; and

(iii) Assist the Bank in seeking to limit or oppose such disclosure.

(j) In the event such disclosure is not successfully limited or opposed:

(i) The Merchant may only disclose that portion of the Confidential Information, as advised by the Bank’s legal counsel, which is legally required to be disclosed. The Merchant shall furthermore exercise its best efforts to obtain assurance that confidential treatment will be accorded to the Confidential Information by the recipient; and

(ii) The Merchant shall not be liable for such disclosure unless it was caused by or resulted from a previous disclosure by the Merchant’s employees, directors or professional advisers (including its representatives) not permitted by the present General Conditions of Use.

(k) In the event of the expiration or termination of this General Conditions of Use for whatsoever reason, each Party shall, within thirty (30) days of such termination, return all the other Party’s Confidential Information, Data Subject, technical information, documents, intellectual property it received pursuant to this General Conditions of Use that it directly has in its possession or under its control, to the other Party in the format agreed between the Parties at the time. Alternatively, if requested by the other Party to do so, it shall delete and remove all such information and provide confirmation to the other Party that it has done so.

(l) As an intrinsic part of its obligations towards the Bank, the Merchant shall facilitate the transmission of any data on an as is basis to any other service provider as expressly indicated by the Bank and free of any charge, cost or fees whatsoever.

8. Data Protection

(a) For the purposes of the present General Conditions of Use, the following words have been defined pursuant to the definition given in the DPA:

(i) “Controller” means a person who or public body which, alone or jointly with others, determines the purposes and means of the processing of personal data and has decision making power with respect to the processing;

(ii) “Data subject” means an identified or identifiable individual, in particular by reference to an identifier such as a name, an identification number, location data, an online identifier or to one or more factors specific to the physical, physiological, genetic, mental, economic, cultural or social identity of that individual;

(iii) “Personal data” means any information relating to a data subject;

(iv) “Personal data breach” means a breach of security leading to the accidental or unlawful destruction, loss, alteration, unauthorised disclosure of, or access to, personal data transmitted, stored or otherwise processed;

(v) “Processor” means a person who, or public body which, processes personal data on behalf of a controller; and

(vi) “Processing” means an operation or set of operations performed on personal data or sets of personal data, whether or not by automated means, such as collection, recording, organisation, structuring, storage, adaptation or alteration, retrieval, consultation, use, disclosure by transmission, dissemination or otherwise making available, alignment or combination, restriction, erasure or destruction.

b) The Merchant, when acting in its capacity as a processor in the performance of this General Conditions of Use, represents and warrants to the Bank, acting as the controller, that it shall:

(i) process the personal data only on documented instructions of the Bank including with regard to transfers of personal data outside of Mauritius (where applicable).

(ii) maintain a record of all categories of processing activities carried out on behalf of the Bank.

(iii) implement appropriate technical and organisational measures to ensure a level of security appropriate to the risk and ensure that processing will meet the requirements of the DPA. In assessing the appropriate level of security, the Company shall take into account, in particular, the risks that are presented by processing, in particular from a personal data breach.

(iv) take reasonable steps to ensure the reliability of any employee, agent, contractor or any other processor (“Subsequent subcontractor”) who may have access to the Personal Data, ensuring in each case that access is strictly limited to those individuals who need to know / access the relevant Personal Data, as strictly necessary, and to comply with applicable laws, ensuring that all such individuals are subject to confidentiality undertakings or professional or statutory obligations of confidentiality.

(v) assist the Bank by appropriate technical and organisational measures, insofar as this is possible, for the fulfilment of the Bank’s obligations set out in the DPA by taking into account the nature of processing and the information available to it.

(vi) at the choice of the Bank, delete or return all the personal data to the Bank after the end of the provision of Services relating to processing and deletes existing copies unless the Company is required to retain such records as required by law.

(vii) not appoint a Subsequent Subcontractor without prior specific or general written authorisation of the Bank. In the case of general written authorisation, the processor shall inform the Bank of any intended changes concerning the addition or replacement of other processors, thereby giving the Bank the opportunity to object to such changes. Where the Company engages the Subsequent Subcontractor for carrying out specific processing activities on behalf of the Bank, the same data protection obligations as set out in the contract between the Company and the Bank shall be imposed on the Subsequent Subcontractor by way of a written contract, in particular providing sufficient guarantees to implement appropriate technical and organisational measures in such a manner that the processing will meet the requirements of the DPA. The Company acknowledges that should the Subsequent Subcontractor fails to fulfil its data protection obligations, the Company shall remain fully liable to the Bank for the performance of the Subsequent Contractor’s obligations;

(viii) not appoint a Subsequent Subcontractor to carry out any processing activity unless adequate due diligence is carried out to ensure that the Subsequent Subcontractor is capable of providing the level of protection for the Bank’s Personal Data as is required under the DPA.

(ix) promptly notify the Bank if it or the Subsequent Subcontractor receives a request from a Data Subject in respect of the Personal Data and ensure that neither it nor the Subsequent Subcontractor respond to that request except on the documented instructions of the Bank.

(x) notify the Bank without undue delay after becoming aware of any personal data breach;

(xi) co-operate with the Bank and take reasonable commercial steps as are directed by the Bank to assist in the investigation, mitigation and remediation of each such personal data breach.

(xii) make available to the Bank all information necessary to demonstrate compliance with the obligations laid down in the DPA and allow for and contribute to audits, including inspections, conducted by the Bank or another auditor mandated by the Bank.

9. Inspection and Audit Rights

(a) Upon reasonable notice, the Merchant shall authorise the Bank to conduct credit inquiries on the Merchant, including but not limited to inquiries on its parent company, its guarantors, and any other party directly or indirectly related to the activities of the Merchant. The Merchant agrees that the Bank shall have the right to request confirmation from the previous or other acquirers on the processing history of the Merchant which includes but not limited to previous or actual sales, chargeback and fraud records and conduct of the Merchant account amongst other parameters. The Merchant further acknowledges and agrees that the representatives of the Bank may inspect, audit and make copies of the books, accounts, records and files of the Merchant, its parent company or any other party directly or indirectly related to the Merchant.

(b) The Merchant also agrees to submit annually, for the Bank’s review, all its audited financial reports. The Parties agree to maintain such documents relating to POP Service for a period of seven (7) years.

(c) If an inspection and/or audit reveal/s that the Merchant is not complying with the terms and conditions stipulated under the General Conditions of Use or the Bank’s requirements, the Merchant shall take, and must ensure that it takes, such actions as are necessary to remedy the non-compliance promptly.

10. Force Majeure

(a) For the purposes of the present General Conditions of Use, « Event of Force Majeure » refers to act of God, earthquake, fire, flood, riots, insurrection, war, act of terrorism or other reasons of like nature which are beyond the control and due to no fault on the part of the Party affected by same (« Affected Party »).

(b) The Affected Party is not responsible for any failure or delay to perform its obligations under the present General Conditions of Use by reason of an Event of Force Majeure. On the occurrence of such Event of Force Majeure, the Affected Party must immediately notify the other party prejudiced by the Event of Force Majeure (« Prejudiced Party ») giving full particulars of the Event of Force Majeure and the reasons for its occurrence and the measures to be taken by the Affected Party to mitigate the effects of the Event of Force Majeure upon the performance of the Affected Party’s obligations under the present General Conditions of Use.

(c) When the Event of Force Majeure ceases, the Affected Party must as soon as reasonably practicable resume the performance of its obligations under the present General Conditions of Use. Furthermore, an Event of Force Majeure does not relieve the Affected Party from liability for any obligation, which arose prior to the occurrence of the Event of Force Majeure.

11. Amendment

No modification or amendment to the present General Conditions of Use shall be valid or binding unless set out in writing and duly executed by

the Parties hereto.

12. Waiver

No failure to exercise and no delay in exercising any right, power or privilege under the present General Conditions of Use shall operate as a waiver thereof nor shall any single or partial exercise of any right, power or privilege preclude the enforcement of any other right, power or privilege. No waiver of any breach of any provision under the present General Conditions of Use shall be taken or held to be a waiver of any subsequent breach of such provision or to be a waiver of the provision itself. No waiver shall be effective unless duly executed in writing.

13. Assignability

The Merchant shall not assign, subcontract or otherwise dispose of all or any part of its rights, liabilities or obligations under the present General Conditions of Use without the prior written consent of the Bank to that effect.

14. Severability

Should any provision of the present General Conditions of Use be declared void or unenforceable by any competent authority or court, the remaining provisions which are capable of severance from the defective or unenforceable provision shall continue to be in full force and effect, provided that these remaining provisions are not deprived of the initial intended purposes of the present General Conditions of Use.

15. Applicable Law

The present General Conditions of Use shall be governed by and construed in accordance with the Laws of the Republic of Mauritius.

16. Partnership, Joint Venture or Principal-Agent Relationship

Nothing under the present General Conditions of Use shall constitute or be deemed to constitute a partnership, joint venture or principal-agent relationship between the Parties hereto and the Merchant shall not hold itself out or allow itself to be held out as a partner or agent of the Bank, and vice versa.

17. Counterparts

The present General Conditions of Use is duly executed in good faith and in two (2) counterparts, each of which shall be deemed to be an original but all of which shall together constitute one and the same instrument.