We all know that motherhood is exciting, unpredictable, and sometimes a bit overwhelming! But amidst the hustle, one thing remains clear: our supermoms are masters of multitasking and resourcefulness. Here are some tips on how POP moms can keep their savings on track! Just like preparing a delicious “pwason sale, satini pom de ter bouyon bred”, managing your finances starts with a plan, whether saving for a family holiday or emergencies, having a plan is the key and POP Save is your ultimate gadget!

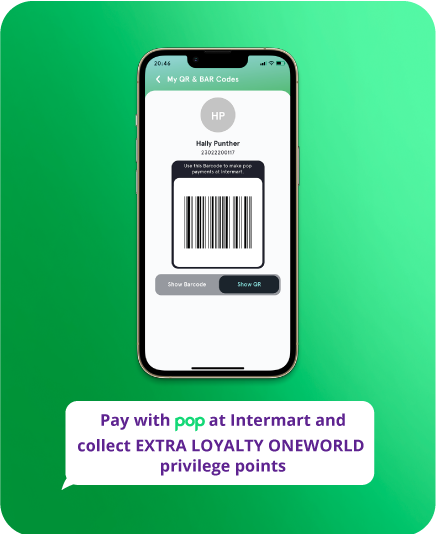

Round-up: A little can go a long way! So, why not try Round Up? It’s just like putting your spare change into a jar at the end of the day. Each time you make a payment on POP, the amount will be rounded up. The difference (your “spare change”) will automatically go into a savings account.

AutoSave: Set it and forget it! Set up how much of your income you would like to set aside every month and POP will do the rest automagically!

Smart Goals: Saving up for your kids’ studies? A family trip? Christmas gifts? With Smart Goals, set a target amount and date, and monitor your progress.

Top Up: Achieve your “plan kanpman” faster with POP. Each time you pay with POP, a fixed amount (you decide how much) goes into a savings account. Each purchase, from groceries to a new pair of shoes, brings you closer to the beach view!

And here’s the cherry on top: you can cash out anytime, plus earn high interest rates paid out monthly! Who knew your phone could be such a money-saving hero?

Remember, a happy mom means a happy family – and a happier wallet!

Our “ramas enn ti kas” culture and finding joy in little moments, make us unique.

With these tips, you’ll be saving like a pro, ensuring that both you and your family can enjoy life’s opportunities.

So, fellow supermoms, let’s dive into this adventure together – Poppin’ Mama style!