A sneak peek into the making of pop

By now, you have probably seen, heard or even tried pop, the first universal digital payment solution available in Mauritius. Simple, fast and secure, pop makes payments as easy as a snap of your fingers. Yes, with pop you can send, receive or request money from anyone, no matter where you bank, and all in real-time! Yet, before pop became your go-to payment app, several teams worked night and day to disrupt and improve your banking experience.

So, how did this adventure begin and what can you expect once you pop ‘in?

Flashback 3 years ago…

In 2018, the Bank of Mauritius launched MauCAS, a digital hub enabling banks and non-bank operators to offer innovative payment services through cards, mobile phones and other channels. It was a turning point that inspired Bank One to take on the challenge of creating a new payment app that would respond to the local need for flexibility, immediacy and security. For the pop team, it was an opportunity to rethink traditional payment methods and disrupt the e-payment landscape! Pop was born out of a desire to help both customers and merchants achieve efficiency in their daily lives (and pamper them with lots of rewards!).

You must be wondering why we deliberately made a choice to launch pop when other payment apps are already present on the market. Well, our decision was truly motivated by our customers and the population at large, who are always searching for better and more convenient payment solutions. Pop is meant to bring value to them and we believe that the challenge was met! With a payment app that can be used by customers of any bank, pop is definitely a first on the local market! Its handy features and smooth interface make it unique, while the real-time notifications and biometric identification contribute to the safe banking experience that we want to offer to users.

Behind the scenes…

One of the first steps in the project was the naming of the app, which was a-not-so-easy issue! Brainstorming sessions, benchmarking, focus groups with customers and colleagues were part of our daily routine as we were looking for a name that would resonate with everyone regardless of their age. Why ‘pop’ you ask? And why not? It’s dynamic, fun, fresh and easy to remember; even a baby can say it! It’s kind of universal, just like the app itself.

So yes, team spirit and open-mindedness were key to this project! (And we all had to quickly hone our interpersonal skills!) We also actively collaborated with service providers, the Bank of Mauritius, merchants and partners which was a rather herculean task. On top of the usual challenges expected when undertaking a project of this magnitude, the COVID-19 crisis and the successive lockdowns required drastic daily adjustments while working from home and trying to adapt to its joys and uncertainties. Our commitment to create a unique app on the market, however, remained unwavering. Fuelled by our desire to make payments effortless and safer for everyone, we will further escalate our efforts to offer even more dynamic and useful features going forward.

Did you know?

Pop is the first payment app in Mauritius to be also available in Creole. Pop believes in bringing mobile payment to all, whether you are a born, raised or adopted Mauritian. It’s simple: Choose Kreol when you register or change your preferred language anytime.

Pop in the making was:

- 140 000 cups of coffee

- 15 000 emails exchanged

- 5 nervous breakdowns

- 500 hours of brainstorming

- 1 yes we did it!

With pop, you can:

- Transfer money instantly to anyone. Any bank to any bank.

- Pay in stores and online.

- Split Bills among friends and across banks.

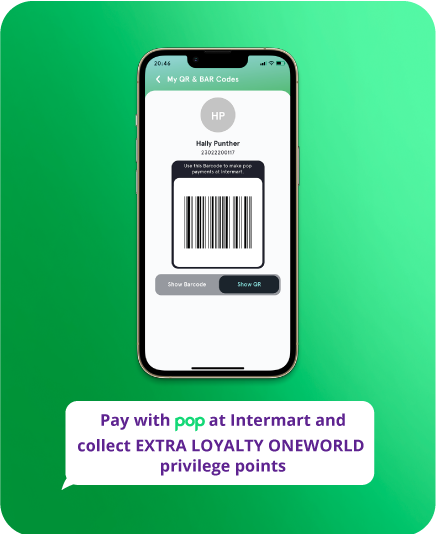

- Enjoy exciting Rewards and Loyalty Benefits.